Live Casino poker Enjoy Live Expert Gambling establishment Tx Chinese Zodiac 1 deposit texas hold’em 2024 Wichtel Akademie München - Alliance for Action AID

- Home

- Live Casino poker Enjoy Live Expert Gambling establishment Tx Chinese Zodiac 1 deposit texas hold’em 2024 Wichtel Akademie München

Jul 02 2025

Live Casino poker Enjoy Live Expert Gambling establishment Tx Chinese Zodiac 1 deposit texas hold’em 2024 Wichtel Akademie München

Posts

Enter the amount from the preprinted parentheses (while the a bad count). The amount from Form 2555, line forty-five, was deducted regarding the almost every other levels of money listed on outlines 8a as a result of 8c and outlines 8e because of 8z. Complete the International Made Taxation Worksheet for individuals who enter a keen count to your Mode 2555, range forty-five. You will want to found a questionnaire 1099-G showing within the field step 1 the complete unemployment payment paid off to you inside the 2024. For individuals who manage a corporate or experienced your own profession since the a best manager, report your income and you may expenses to your Schedule C. For those who gotten a questionnaire 1099-K to possess an individual goods you marketed in the an increase, never statement that it count regarding the admission room ahead out of Schedule 1; rather report it you would declaration all other money gain to the Setting 8949 and Plan D.

Sort of Dvds

In some instances, we could possibly call you to respond to your own query, otherwise charge you more information. Don’t mount interaction to the income tax get back until the fresh communication identifies a product or service to your get back. Efforts built to it financing might possibly be distributed to the bedroom Agency for the Ageing Councils of Ca (TACC) to include suggestions about and you can sponsorship from Elderly people items. In this case, mount a duplicate of your own federal Mode 1040 otherwise 1040-SR get back and all help federal models and you can schedules to create 540. 3rd party Designee – If you wish to let your preparer, a buddy, family member, or any other people you decide to talk about their 2024 income tax return on the FTB, see the “Yes” field on the trademark section of their tax get back.

You’ve got no licensed returns of XYZ Corp. as you held the new XYZ inventory at under 61 months. Should you get a great 2024 Mode 1099-INT to possess You.S. discounts bond desire detailed with quantity your claimed before 2024, discover Club. Don’t tend to be desire gained on your IRA, health checking account, Archer otherwise Medicare Advantage MSA, navigate to the website otherwise Coverdell knowledge bank account. When you’re typing amounts that are included with dollars, make sure to are the decimal area. When you have to add two or more numbers to figure the amount to enter to your a column, are dollars when adding the fresh numbers and bullet out of only the full. A registered residential companion within the Las vegas, nevada, Washington, otherwise California have to fundamentally declaration half the brand new joint community income away from anyone and their home-based companion.

Whenever usually my personal repayments to function?

Offered the appropriate conditions are met, this will enable it to be one in order to claim a different to the promoting a corporate to help you a worker collaborative. Finances proposed income tax laws to helps producing worker control trusts (EOTs). Such legislative proposals are ahead of Parliament within the Statement C-59.

People that do not post the newest payment digitally will be topic to help you a 1percent noncompliance punishment. California rules adapts so you can federal legislation that enables mothers’ election so you can declaration a young child’s desire and you may dividend income away from a young child less than ages 19 otherwise a complete-date college student below many years 24 to your mother or father’s income tax go back. If you need to amend their Ca resident taxation come back, over a revised Form 540 2EZ and check the box from the the top Function 540 2EZ appearing Revised come back. Attach Schedule X, Ca Cause away from Revised Go back Changes, to your amended Function 540 2EZ. To possess certain guidelines, discover “Tips to have Submitting a 2024 Amended Come back”.

Failed to get the complete first and you may second money? Claim the newest 2020 Recuperation Rebate Credit

Install a statement number the new day and you will year of your own other agreements. Not one of your own refund are nonexempt when the, around your paid the fresh taxation, you either (a) didn’t itemize write-offs, otherwise (b) select in order to deduct state and you will regional general conversion taxation instead of state and you can local income taxes. Where’s My personal Refund does not tune refunds that are claimed on the an amended taxation go back. To check the new status of one’s reimburse, visit Irs.gov/Refunds otherwise use the 100 percent free IRS2Go app, around the clock, 7 days a week. Information about their refund will normally be available within 24 hours after the Irs gets the e-submitted go back or four weeks once you mail a magazine come back. But if you recorded Form 8379 together with your go back, allow it to be 14 weeks (eleven weeks for those who recorded electronically) just before checking the reimburse status.

It is because the new tend to short term characteristics out of college student residences plus the unique GST/HST regulations you to apply to these organizations. This type of criteria is actually premised to the idea of a shared finance company being widely stored. However, a corporation subject to a corporate category can get qualify because the a good mutual money company while it is not widely stored. The money Tax Operate includes special regulations to possess shared financing businesses one to assists conduit solution to investors (shareholders). Including, such laws and regulations basically enable it to be money progress understood because of the a common money corporation becoming handled while the money gains know by the investors. At the same time, a mutual financing business isn’t susceptible to mark-to-industry tax and will choose funding progress treatment to the disposition from Canadian ties.

This will are one idea income your didn’t are accountable to your boss and you may one allocated resources revealed in the field 8 in your Function(s) W-2 unless you can be that the unreported tips try shorter compared to amount inside box 8. Have the worth of one noncash information your acquired, including passes, passes, or other pieces of well worth. When you wear’t report this type of noncash suggestions to your boss, you need to statement her or him on the internet 1c. In the event the a mutual return, have your own partner’s income from Form(s) W-dos, package 1.

Since the Form 2210 is actually challenging, you could log off range 38 empty as well as the Irs tend to shape the fresh penalty and you will give you a bill. We wouldn’t ask you for attention on the penalty for individuals who shell out from the date given for the statement. You can find situations where the fresh Irs are unable to figure your penalty to possess you and you ought to file Setting 2210. In case your Exclusion only discussed doesn’t use, comprehend the Tips to possess Form 2210 with other things in which you are in a position to lower your punishment by filing Function 2210.

Stop the us government Pension Offset create increase month-to-month advantages inside December 2025 by typically 700 to own 380,one hundred thousand readers delivering benefits according to way of life spouses, depending on the CBO. The increase might possibly be normally step one,190 to possess 390,000 otherwise thriving spouses taking a great widow or widower work for. These types of pros will build over the years relative to Societal Security’s cost-of-lifestyle alterations. Transform is true of advantages from January 2024 forth, meaning particular recipients will discover straight back-old costs. One of many eligibility conditions for an excellent GST Leasing Rebate is the fact that the tool is for enough time-name rental.

The employment income tax has been in effect inside the California because the July step 1, 1935. They relates to requests from presents for usage inside the Ca of out-of-condition suppliers which can be much like the conversion process tax paid off on the orders you will be making inside the Ca. When you yourself have perhaps not currently paid off the fool around with income tax on account of the brand new California Service out of Income tax and you may Payment Government, you happen to be capable report and you can pay the fool around with tax due on the county tax get back. Understand the advice below and also the tips to possess Range twenty-six out of your earnings taxation go back. Firefighters Very first Borrowing Union brings legendary service in order to firefighters as well as their family members across the country.

An increase to possess bank places

Have a tendency to my personal month-to-month Public Security fee improve otherwise reduced amount of February 2025? Of several beneficiaries should expect a modest boost in monthly payments due for the yearly Costs-of-Way of life Variations (COLA). However, specific higher-money receiver could see reduced pros or enhanced taxation on the Societal Protection earnings in line with the the newest money supports. But not, these types of alter have challenges, and staffing slices and also the recuperation out of overpaid professionals.

Utilize the Where’s My personal Amended Return software for the Internal revenue service.gov to trace the new status of your own revised return. It takes as much as step three months on the day your shipped they to show up in our program. You can file Form 1040-X digitally which have income tax submitting app in order to amend Forms 1040 and 1040-SR. Find Internal revenue service.gov/Filing/Amended-Return-Frequently-Asked-Questions to find out more. Area D—Explore should your processing status is Lead out of home. Basically, anyone you pay to set up your go back have to signal it and you can tend to be its Preparer Taxation Identification Amount (PTIN) in the room given.

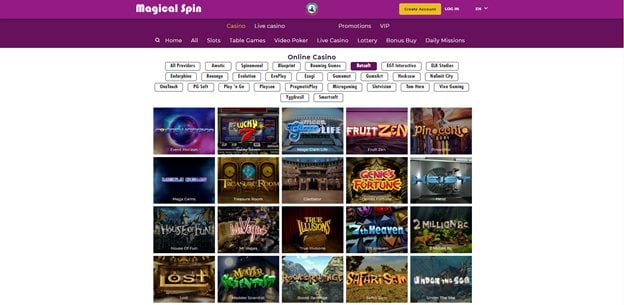

When you use some advertisement clogging app, please view its options. A platform intended to show the operate aimed at bringing the eyes out of a less dangerous and much more clear gambling on line community to help you truth. 100 percent free top-notch academic courses to possess internet casino personnel geared towards industry best practices, boosting user experience, and you will reasonable method to gaming.

JICTS Limited

- Open Hours of AFAA: Mon - Fri: 8.00 am. - 6.00 pm.

- Hai Tarawa, Head office, Juba, South Sudan

- +211916165022 , +211 918505019, +211 918505019