best cryptocurrency to invest april 2025 - Alliance for Action AID

- Home

- best cryptocurrency to invest april 2025

Aug 02 2025

best cryptocurrency to invest april 2025

Best cryptocurrency to invest april 2025

The U.S. Securities and Exchange Commission now shows more openness toward crypto regulation. It is backing new Bitcoin ETFs while establishing stablecoin guidelines https://thereddog.net/. European Union’s MiCA regulations have also become fully operational to protect investors and build institutional trust in the sector.

As blockchain networks grow, the need for efficient dispute resolution mechanisms has become apparent. In 2025, on-chain governance systems and smart contract-based arbitration are gaining traction as viable solutions to disputes arising in decentralized ecosystems. These systems offer automated and transparent ways to address conflicts without relying on traditional legal frameworks.

The benefits are clear: faster resolution times, reduced costs and enhanced trust among network participants. This trend holds particular importance for enterprises adopting blockchain technology, as robust governance structures will be essential to scaling their operations securely and confidently.

Cryptocurrency market outlook april 2025

President Donald J. Trump has embraced cryptocurrency by launching a Strategic Bitcoin Reserve, Congress is moving forward with stablecoin and regulatory legislation for digital assets, and corporations are adding more bitcoin to their balance sheets.

Leverage and liquidation risk: The current leverage ratio in the cryptocurrency market is relatively high (perpetual contract funding rates have recently rebounded), if CPI data triggers violent price fluctuations, it may trigger large-scale liquidations. For example, after the February CPI data was released, Bitcoin’s trading volume surged 40% within 1 hour, with obvious panic selling. Additionally, tariff policy and inflation transmission: The automobile import tariffs (25%) implemented by the Trump administration on April 2 may push up US import costs, exacerbating imported inflation pressure. If March CPI data exceeds expectations as a result, the market may further worry about Fed policy tightening, putting pressure on crypto assets.

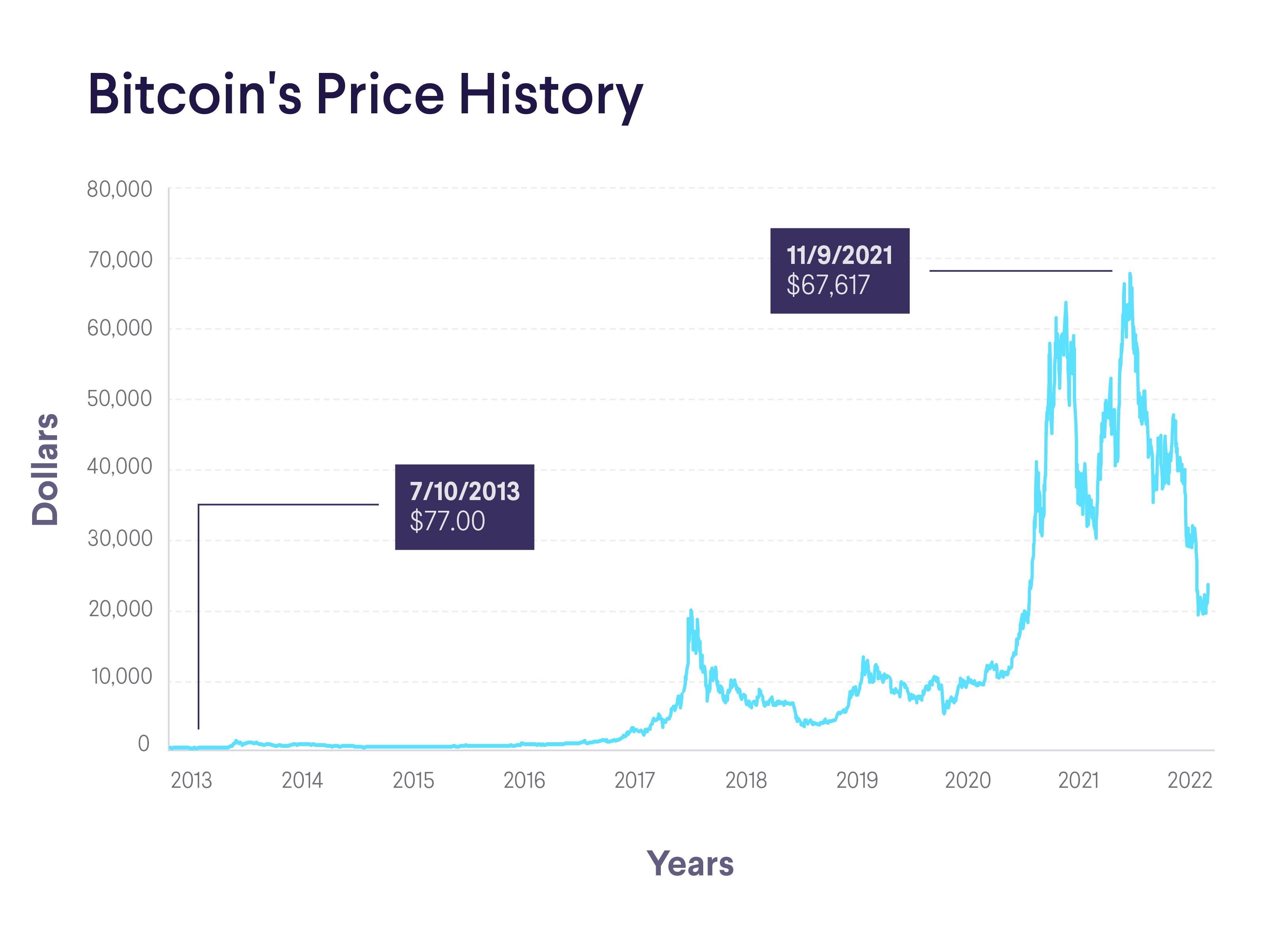

From the chart above, we can see that historically in April, Bitcoin has had more positive returns overall. Out of 12 years, the ratio of rises to falls is 8:4, indicating that upward trends have an absolute advantage. In the second year after the previous three halvings, i.e., 2013, 2017, and 2021, the rise-to-fall ratio was also 2:1. Overall, historical data shows that April is often a month of market sentiment adjustment and significant volatility for Bitcoin.

President Donald J. Trump has embraced cryptocurrency by launching a Strategic Bitcoin Reserve, Congress is moving forward with stablecoin and regulatory legislation for digital assets, and corporations are adding more bitcoin to their balance sheets.

Leverage and liquidation risk: The current leverage ratio in the cryptocurrency market is relatively high (perpetual contract funding rates have recently rebounded), if CPI data triggers violent price fluctuations, it may trigger large-scale liquidations. For example, after the February CPI data was released, Bitcoin’s trading volume surged 40% within 1 hour, with obvious panic selling. Additionally, tariff policy and inflation transmission: The automobile import tariffs (25%) implemented by the Trump administration on April 2 may push up US import costs, exacerbating imported inflation pressure. If March CPI data exceeds expectations as a result, the market may further worry about Fed policy tightening, putting pressure on crypto assets.

Cryptocurrency market trends april 2025

SEC Chair Paul Atkins created the Cyber and Emerging Technologies Unit (CETU) to develop clear guidelines for crypto token registration and disclosure. The Commodity Futures Trade Commission (CFTC) has also enhanced its oversight to better regulate the market with the launch of its digital asset markets pilot program, which covers tokenized non-cash collateral. These efforts mark a period of a more proactive regulatory approach, rather than relying on enforcement actions to retroactively define policies.

The cryptocurrency market’s volatility can be attributed to several factors. Bitcoin’s dominance increase suggests a flight to safety as investors possibly view it as a hedge against broader market uncertainty. Ethereum’s significant downturn, on the other hand, could be influenced by its reduced market dominance and possibly internal ecosystem challenges.

April 2025 crypto market outlook: Analysis of Fed policy, Trump tariffs, ETH Pectra upgrade, and inflation data. Will Bitcoin’s historical April strength prevail despite limited catalysts? Market projections through June.

- Open Hours of AFAA: Mon - Fri: 8.00 am. - 6.00 pm.

- Hai Tarawa, Head office, Juba, South Sudan

- +211916165022 , +211 918505019, +211 918505019

Leave A Comment